Polk County finishes 2017 with healthy fund balance

Published 1:13 pm Thursday, January 4, 2018

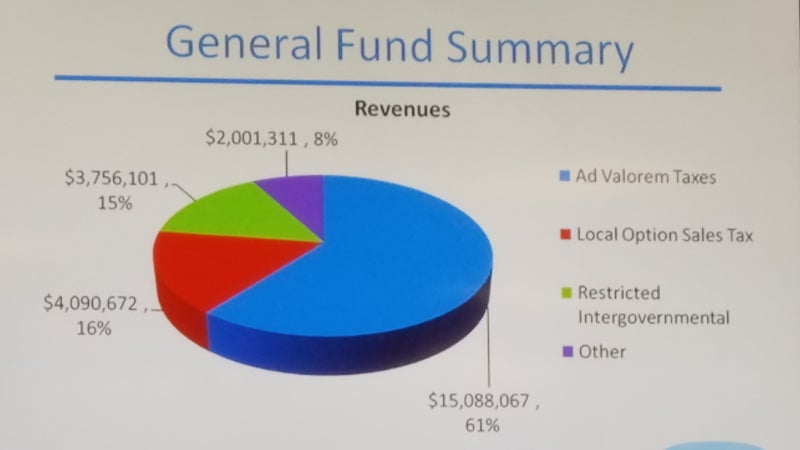

- Polk County received its annual audit for fiscal year 2016-2017, which ended June 30, 2017. Pictured is a graph of revenues the county receives, with the majority coming from property taxes.

COLUMBUS – Polk County had another healthy year, according to its annual audit report, finishing with a 29 percent fund balance and departments ending with positive revenues over expenditures.

The Polk County Board of Commissioners met Dec. 18 and heard from Tonya Marshall and Dan Mullinix, with Gould Killian CPA Group, P.A., who performed the county’s audit for fiscal year 2016-2017, which ended June 30, 2017.

Financial highlights for the county include that the county’s net position increased by $3,065,977, primarily because of continued operating efficiencies, a 2-cent property tax increase, a slight increase in the county’s property tax collection rate and increases in all revenue sources for an overall revenue increase of approximately nine percent, according to the audit report.

Capital assets of Polk County increased overall by $5,389,012 after depreciation, according to the audit, mostly because of the construction and land costs incurred on the new law enforcement facility.

The county’s annual debt also increased last fiscal year by $11,725,520, from proceeds the county received from a loan to build the new law enforcement center.

The county’s total unreserved fund balance available for spending is $7,304,048, or 29 percent of total general fund expenditures, which is a decrease in percentage from the prior few years, but more money available than last fiscal year. Fund balance percentage is calculated on how much savings the county has available based on its general fund expenditures for that year.

Polk ended fiscal year 2015-2016 with a 31.1 percent available fund balance, or $7,243,305. In fiscal year 2014-2015, the county had a 32.8 percent fund balance, or $7,714,340, according to past audit reports.

Polk County had a fund balance of $8,460,188 available for spending at year-end 2014, which at the time was 40.16 percent of its general fund expenditures.

Marshall said last year Polk’s fund balance is still healthy as the county average across the state was 27.5 percent in 2016. The population group average was 34.7 percent available fund balance in 2016. The state requires local governments to keep at least eight percent available in fund balance.

Polk County collected 97.51 percent of its taxes for fiscal year 2016-2017 compared to 97.33 percent the previous year. Polk collected 97.32 percent of its property taxes and 100 percent of its motor vehicle taxes (motor vehicle taxes are now collected by the state).

Mullinix said last fiscal year (2015-2016) the county had some findings for the department of social services (DSS) because of a required software transition last year. Marshall said everyone had issues implementing the new system, it required hours of training, and a lot of “bugs” had to be worked out. This is the second year Polk DSS is using the new system and has implemented its corrective action plan, according to Marshall.

County manager Marche Pittman said there was a lot of finger pointing when the system was rolled out, and the system the state put out was broken. He said the issues were certainly not the county’s fault.